The Ultimate Guide to Buying a New Construction Home

Something magical happens when you step foot inside a new construction home. Perhaps it’s the smell of fresh paint on the walls or the thrill of seeing your carefully selected finishes come to life. Or maybe it’s the realization that you and your family will be the first to transform a shiny new house into a warm and inviting home.

Whatever the reason, new construction homes are certainly a hot commodity—especially in today’s market. With real estate experts predicting another “sellers’ market” in 2022, buying a new construction home nonetheless remains top-of-mind for many homebuyers.

Despite the excitement surrounding new builds, purchasing a home (whether new or pre-owned, for that matter) can often be a long, tedious process for first-time buyers and seasoned pros alike. Not to worry, though: If navigating the world of new construction homes feels a bit overwhelming, you’ve come to the right place.

At Brock Built, we’ve been building in and around the Atlanta area for nearly four decades, so it’s safe to say we know a thing or two about the behind-the-scenes magic that goes into planning, building, and buying a new construction home. Now, we’re channeling our experience and expertise into a comprehensive guide. From the benefits of buying new construction to a step-by-step look at the entire process, we’re unpacking everything you need to know about the new construction home buying process.

Benefits of a New Construction Home

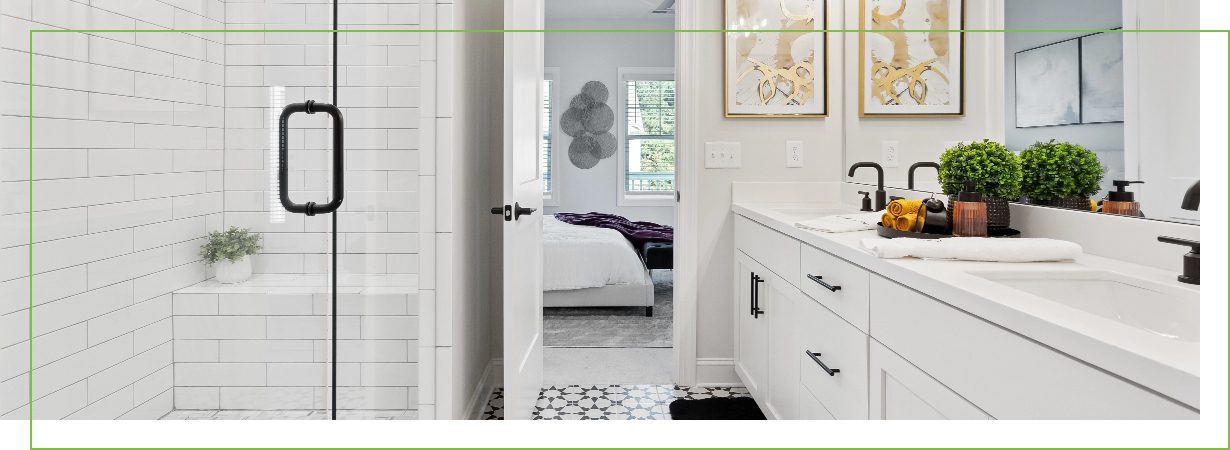

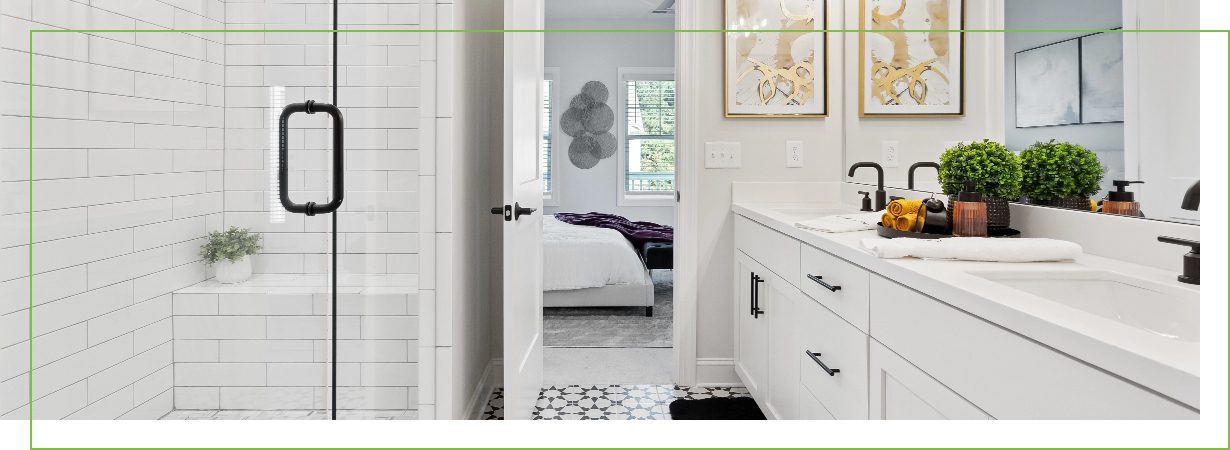

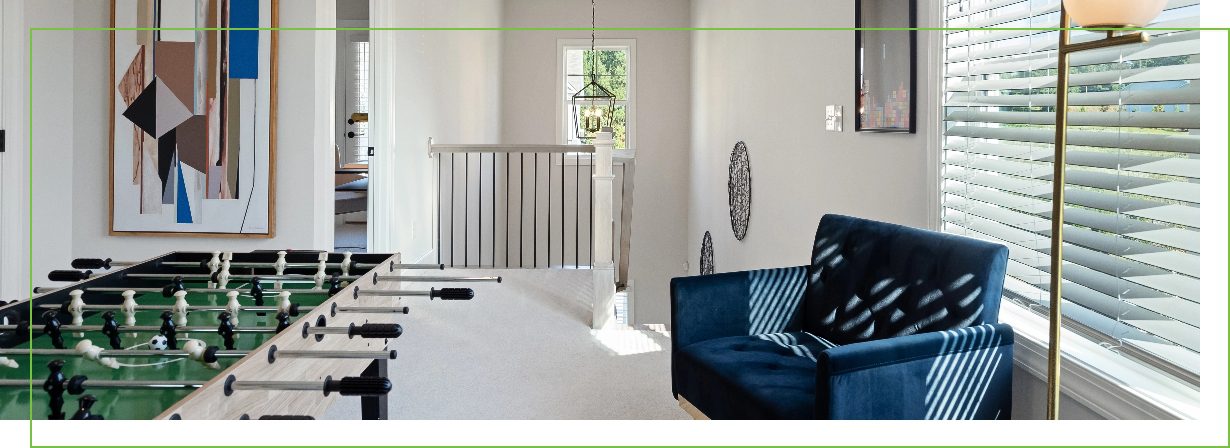

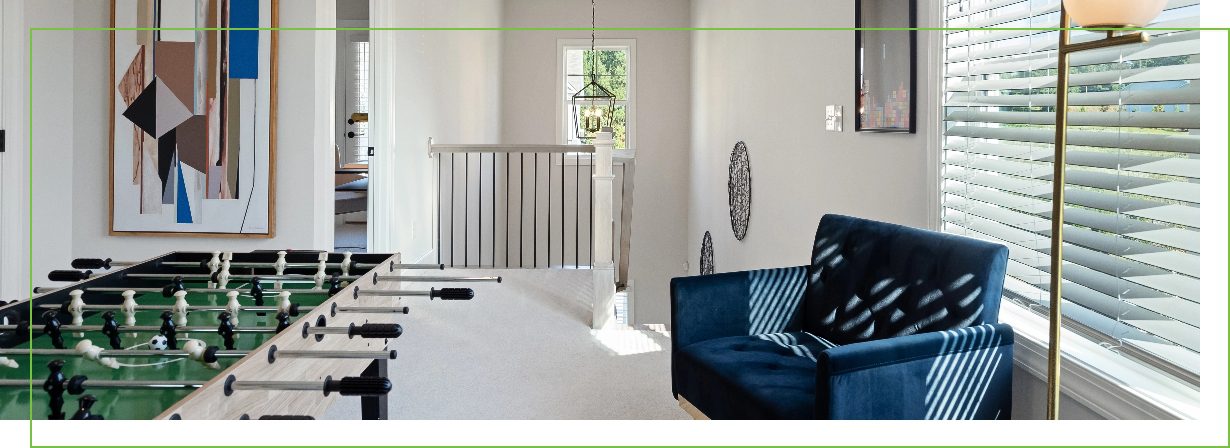

When you think about new construction homes, what details come to mind? Often, it’s the gorgeous granite countertops, open floor plans, modern design features, and other aesthetic details that initially captivate buyers at first glance.

While these beautiful, eye-catching finishes are certainly part of the allure, dig a little deeper and you’ll discover that new construction homes boast a whole list of practical benefits, too. Here’s a look at some of the benefits that new construction homes have to offer.

New Construction Homes vs. Pre-Owned Homes

| New Construction Homes | Pre-Owned Homes | |

|---|---|---|

| Personalized for You | ||

| Move-In Ready | ||

| Energy-Effecient | ||

| Home Builder Warranty | ||

| Home Builder Financing Incentive | ||

| Price Point | ||

| Maintenance |

PROS & CONS OF NEW CONSTRUCTION HOMES

Based on our comparison chart above, you’ll see that new construction homes have quite a few things going for them. When working with a reputable builder, there’s little you have to worry about in regards to maintenance and other issues that could arise with an older, pre-owned home. Let’s break it down:

-

Personalized for You

New construction homes may have more design options that can be personalized to fit your specific style. From light fixtures and cabinet hardware to paint colors and countertops, selecting the perfect finishes is easy when your home build is in progress.

-

Move-In Ready

Some people enjoy taking on a top-to-bottom remodel. If you’re not one of those people, new construction homes are perfect for you as they are completely move-in ready. No DIY projects to worry about—just bring your furniture and you’ll be ready to settle in on day one!

-

Energy-Efficient

New homes tend to be more energy-efficient because they’re built with the latest materials and technology. For example, utilizing energy-efficient windows, insulation, lighting, and appliances can all make a major difference in the energy usage of your home.

-

Home Builder Warranty

New construction homes typically come with a home builder warranty to ensure the quality and performance of your new build. Brock Built, for example, offers a comprehensive one-year limited warranty that covers repairs that may arise in your new home during the first year of ownership. Learn more about new home warranties here.

-

Home Builder Financing Incentive

Many builders offer financial incentives, like discounts on closing costs, that can benefit the buyer.

-

Maintenance

A home that’s completely new is significantly less likely to require repairs or expensive maintenance in the immediate future than a home that’s 10, 20, or 30+ years old.

In the past, new builds were slightly more expensive than their pre-owned counterparts—especially considering the rising cost of labor and materials. But in today’s market, pre-owned homes can be even more costly due to the demand. In fact, many buyers are forced to make offers above asking price in order to secure a pre-owned home.

On the other hand, there’s no denying the vintage charm that many older homes possess. Craftsman, mid-century modern, and even Victorian homes are all coveted for their uniquely exceptional details. And while today’s design trends are certainly appealing, classic never goes out of style.

Nonetheless, new construction homes are, overall, incredible investments that can appeal to all different types of buyers.

The New Construction Home Buying Process

The benefits of buying a new construction home are well established. So, what comes next when you decide on a new build? Let’s take a look at the step-by-step process of securing your new construction home.

Do Your Research

Before making a big purchase, accepting a job offer, or even just trying a new restaurant, most people preemptively do one thing: research! This step is vital in any decision-making process, and buying a home is no different. Here are a few factors to consider as you begin your home-buying journey.

Research the Builder: When it comes to selecting a builder, due diligence is key. Like anything, there are “good” and “bad” options to choose from—so choose carefully! Read testimonials, visit model and inventory homes, ask thorough questions to the sales consultant and builder in the community, and even talk to homeowners they’ve worked with before.

Read more about How to Find a Home Builder That’s Right for You >>

Research the Market: What does the housing market look like in your area? Are homes selling fast (hint: they probably are at this point in time)? By researching market trends, you’ll have a better idea of how fast you need to move and how much you should offer.

Read more about The Housing Market here >>

Research the Area: Deciding where you want to live is crucial. Do you want to be in a good school district? Live in a location that’s convenient to work? Want access to shopping and dining? Prefer to be outside the city? Knowing the primary location will help you hone in on your house search.

Real Estate Terms Every New Home Buyer Should Know

- Appraisal: A real estate appraisal is a valuation of a home and/or property. It’s required by the lender to determine the market value and must be conducted by a licensed appraiser.

- Closing Costs: Closing costs include the fees and expenses incurred during the sale of a home. They typically include costs for title insurance, attorney fees, appraisals, taxes, and more.

- Contingencies: In real estate, contingencies are conditions and/or actions that must be met prior to completing the sale of a home. Common contingencies include home inspection, financing, and appraisal.

- Home Inspection: A home inspection is the examination of a home to determine its safety and condition.

- Escrow: Escrow is a legal arrangement in which a third party handles and disburses money/property as the terms of the agreement are met. This arrangement protects both the buyer and seller in the home buying process.

- Listing: Real estate listings are typically thought of as home descriptions, but they are actually legal agreements between a property owner and a real estate broker that authorize the broker to represent the seller and handle the sale.

- Pre-Approval: A pre-approval is a preliminary review of a potential buyer to determine if they are pre-qualified for a mortgage.

- Offer: An offer is a proposed conditional amount made by the homebuyer to the seller. It typically includes specific terms along with the dollar amount.

- Title Insurance: Title insurance protects lenders and buyers against any defects in the property title during the transfer of ownership.

Want to learn more about home buying terms? Check out our blog post, A First Time Home Buyer’s Guide to Real Estate Vocabulary.

Choose Your Lender

Now that you’ve done your research, it’s time to start thinking about financing. If you’re not paying in cash, you’ll need a mortgage to purchase your home. The process should look something like this:

- Start the pre-approval process. Even before you start looking at houses, you’ll want to get pre-approved for a mortgage. This process will tell you how much you are qualified to borrow. Most builders have preferred lenders that offer different incentives, so be sure to check in with them during this process.

- Receive your approval letter. Now, you are officially pre-qualified and can begin house hunting.

- Go under contract on your new construction home. Once you find the home of your dreams, go under contract on your home. Be sure to review all of the contract details with your sales agent.

- Begin the verification process. An underwriter takes an even deeper look at your finances. During this time, the appraisal also occurs in order for the lender to verify the property details. Once complete, you will receive a closing disclosure that outlines everything you need to know about your mortgage.

- Communicate prior to closing. Prior to closing, you can schedule orientations and weekly (or biweekly) communication with the sales agent to ensure everything is on track.

- Close on your new home. Bring your closing disclosure to closing, sign the paperwork, and voilà! You’re officially a homeowner.

A word of advice: Be sure to compare rates! Local lenders may offer better interest rates, so it pays to shop around. Want to learn more about securing a mortgage? Click here!

Review the Builder Contract & Your Home's Specific Details

In between your pre-approval process and making an offer, you’ll want to review the builder contract. This is vital to understanding the timeline, specifications, and any specific clauses in the contract.

Always review your contract carefully—it’s a legally binding agreement, so make sure that you understand what is in the contract about your new home. Depending on the stage of construction, you may be able to make customizations to your new home. For example, you may be able to personalize certain features and fixtures of your Brock Built home or choose from carefully curated design packages that might include:

- Countertops

- Hardware

- Paint colors

- Light fixtures

If you cannot make any customizations, you want to make sure that you know what the contract states is included in your new home.

Make a Design Center Appointment

Reviewing contracts is par for the course, but visiting the Brock Built Design Center is truly where the magic happens! Although not everything can be personalized in your new construction home, our design experts select top-of-the-line, on-trend designs for Brock Built Homes.

After signing the contract, our design team will reach out to book an appointment. You can visit the design studio to review your home's selections and begin dreaming of how your final home will appear once the selections are installed!

Meet with the Sales Agent

It’s a good idea to meet with your sales agent—both initially and throughout the construction process. Depending on the phase of construction of the home when you go under contract—and depending on the specific builder's process—you may have certain meetings that are required as a part of the builder's home building process that your sales agent can help arrange.

Additionally, make sure that your sales agent thoroughly explains to you what meetings are required of you in the process and what additional meetings you can schedule in order to get more opportunities to view and discuss the construction of your home. These meetings are a great opportunity to ask questions, receive updates, and get a first-hand view of the home-building process.

Between this step and the net, there will likely be a lot of communication between you and your sales agent regarding the status of your home. Our goal is to keep you updated every step of the way.

Complete the Home Inspection & Final Walkthrough

Good news: You’re in the home stretch! Once the construction of your new home is complete and all upgrades have been made, you may choose to schedule a home inspection. While not required for new builds, home inspections are nonetheless a good idea to ensure the quality and safety of your potential new home. Once the inspection has been completed and any outstanding issues have been remedied, a final walkthrough will be conducted before closing.

FAQs About Buying a New Construction home

In the past, new construction homes tended to be higher in price when compared to existing homes. That’s because, well, everything is brand new! Factors like location, square footage, and property size all come into play here, too. However, in today’s market, pre-owned homes can cost even more than new construction due to low supply and high demand. And while a new construction home may or may not be more expensive up front, you’re less likely to run into major maintenance issues or costly repairs than you may encounter with an older, pre-owned home.

Buying a New Construction Home with Brock Built

Now that you have a better understanding of the new construction home buying process - explore Brock Built Homes.

We pride ourselves in building new construction homes of exceptional quality—but it’s so much more than that. Our homes are built where you want to live so that you love living there! Surrounded by parks, shops, restaurants, local attractions, and so much more, every Brock Built Community was designed with your lifestyle in mind.

Want to see what Brock Built has to offer? Check out our communities with available new construction homes and contact us today to start experiencing the magic of new construction homes.